Storing gold securely is a crucial part of owning the asset, whether it is held for long-term protection or for active trading. Unlike digital investments, physical gold carries unique responsibilities, including proper handling, storage, insurance and verification. For U.S. investors, understanding how to store gold safely and comply with security best practices can significantly reduce risk and preserve the value of their holdings. This guide explains the major storage methods, the importance of audits and how security standards in the United States help protect gold owners.

Gold storage begins with choosing between at-home storage and professional vaulting services. Some investors prefer to keep gold in their possession because it gives them direct access and eliminates the need to rely on third parties. However, home storage requires careful planning. Gold must be stored in a secure safe that is resistant to fire, humidity and tampering. The safe should be kept in a discreet location, and homeowners may need specialized insurance to protect their assets in case of theft or damage. While at-home storage offers independence, it requires strict attention to security details to avoid unnecessary risks.

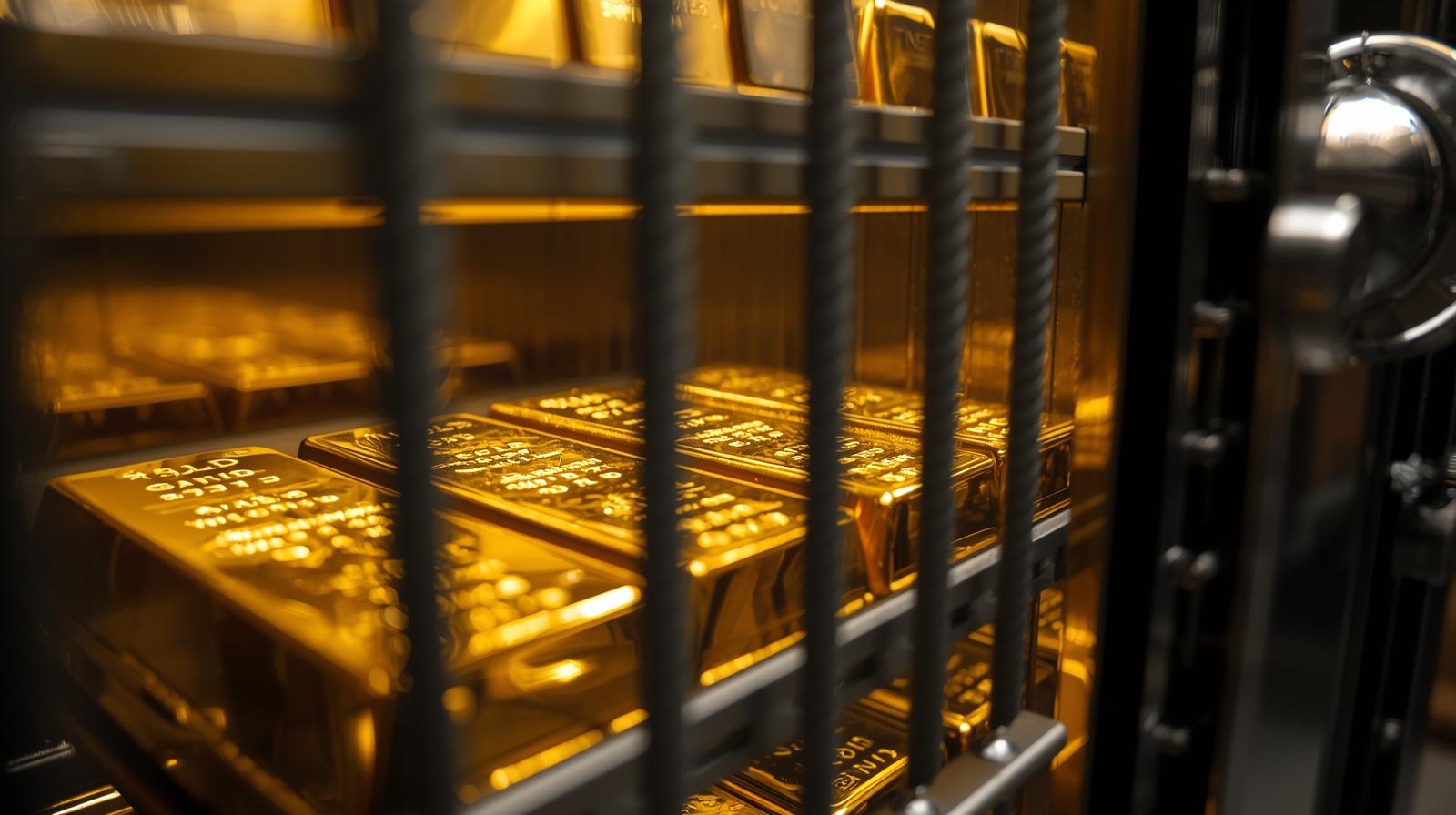

For many U.S. investors, professional vaulting is the preferred method of storing gold. Vaulting facilities are designed to meet high security standards and protect large volumes of precious metals. These facilities use multiple layers of protection, including surveillance systems, restricted access, armed security personnel and climate-controlled storage units. Professional vaults also provide insurance coverage that protects the value of stored gold. This level of security is especially appealing to investors who want peace of mind and reliable documentation of their holdings.

Segregated and non-segregated storage are two common vaulting options. Segregated storage means the investor’s gold is stored separately, clearly labeled and not mixed with any other client’s holdings. This arrangement ensures that the exact bars or coins deposited are the same ones returned. Non-segregated storage, on the other hand, stores gold alongside other holdings of the same type. While still secure, the investor receives an equivalent item upon withdrawal, not the specific piece originally deposited. The choice between the two depends on the investor’s preference for exclusivity, cost and liquidity.

Insurance is another essential part of gold storage. Professional vaults typically include insurance in their storage fees, guaranteeing protection against theft, damage or loss. Investors storing gold at home may need to purchase additional coverage because standard homeowner policies often do not fully cover precious metals. Proper insurance documentation preserves financial security and ensures that the asset’s value is protected under unexpected circumstances.

Audits and verification procedures play a key role in maintaining trust and transparency in gold ownership. Reputable U.S. vaulting providers conduct regular third-party audits to confirm that all stored gold is accounted for and meets purity and weight standards. These audits provide investors with independent verification that their holdings are secure and accurately documented. Audits also ensure that custodians are following the proper procedures for handling and reporting gold inventory. For investors, this layer of oversight enhances confidence and reduces the risks associated with mismanagement or fraud.

Security extends beyond physical protection. Recordkeeping and documentation help investors track their gold effectively. Certificates of authenticity, purchase invoices and storage receipts serve as proof of ownership and are often required for insurance claims or resale transactions. Keeping organized records helps ensure smooth transfers and provides clarity during tax reporting or estate planning.

For traders who prefer to avoid the responsibility of physical storage, digital or allocated gold options provide an alternative. These forms represent direct ownership of gold stored in professional vaults without the need for personal handling. Investors can buy, sell or transfer gold through digital platforms while relying on secure custodians for storage. This approach combines the stability of gold ownership with the convenience of modern financial technology.

Understanding gold storage and security allows U.S. investors to protect one of the most reliable and enduring assets in global finance. Whether choosing to store gold at home or in a professional facility, the right security measures ensure that the metal retains its value and integrity over time. By relying on proper storage methods, verified audits and strong documentation, investors can approach gold ownership with confidence, knowing their wealth is safeguarded under all conditions.