Gold has held a significant place in global finance for thousands of years, and its relevance continues in the modern United States economy. While digital currencies and innovative financial instruments have gained popularity, gold remains a timeless asset valued for its stability, scarcity and resilience during economic uncertainty. Understanding why gold maintains its strength as an investment helps traders and long-term investors build balanced portfolios that can withstand market volatility.

Gold’s enduring value begins with its scarcity and intrinsic worth. Unlike fiat currencies, which can be expanded through monetary policy, gold has a limited supply that cannot be artificially increased. This natural scarcity contributes to its ability to preserve purchasing power over generations. Many U.S. investors view gold as a hedge against inflation, especially during periods when the dollar weakens or the cost of living rises. When confidence in fiat currencies fluctuates, gold often gains attention for its consistent ability to retain value.

Historically, gold has performed well during economic downturns. When stock markets experience turbulence or recession threats emerge, demand for gold usually increases. This pattern reflects its role as a safe-haven asset, meaning it is sought after during times of uncertainty. Gold does not depend on the earnings of a company, the performance of a government or the success of technological innovation. Instead, its value is influenced by global supply, demand and investor sentiment. For U.S. traders, gold’s independence from traditional financial systems provides a protective counterbalance to riskier assets.

Interest rates also play a major role in the movement of gold prices. In the United States, when interest rates are low, gold tends to become more appealing because it does not provide interest or yield on its own. During low-rate environments, the opportunity cost of holding gold decreases, making it more competitive compared to bonds or savings accounts. Conversely, rising interest rates can temporarily reduce demand for gold, although long-term fundamentals often keep it strong. Understanding the relationship between rates and gold helps investors anticipate market behavior.

Another reason gold remains a reliable asset is its global recognition and universal liquidity. Gold is traded internationally and holds value across cultures and economies. In the U.S. market, this global acceptance creates consistent demand. Gold’s versatility also contributes to its strength. It is used in jewelry, technology, manufacturing and central bank reserves. These multiple applications support its value beyond investment speculation, giving it a foundation grounded in real-world utility.

Geopolitical events often have a significant impact on gold prices. Tensions between nations, trade disputes and unexpected global events frequently drive investors to seek security in gold. During times of international instability, many U.S. investors diversify their portfolios with gold to reduce overall exposure to risk. This behavior reflects the asset’s long-standing reputation as a dependable refuge in unpredictable environments.

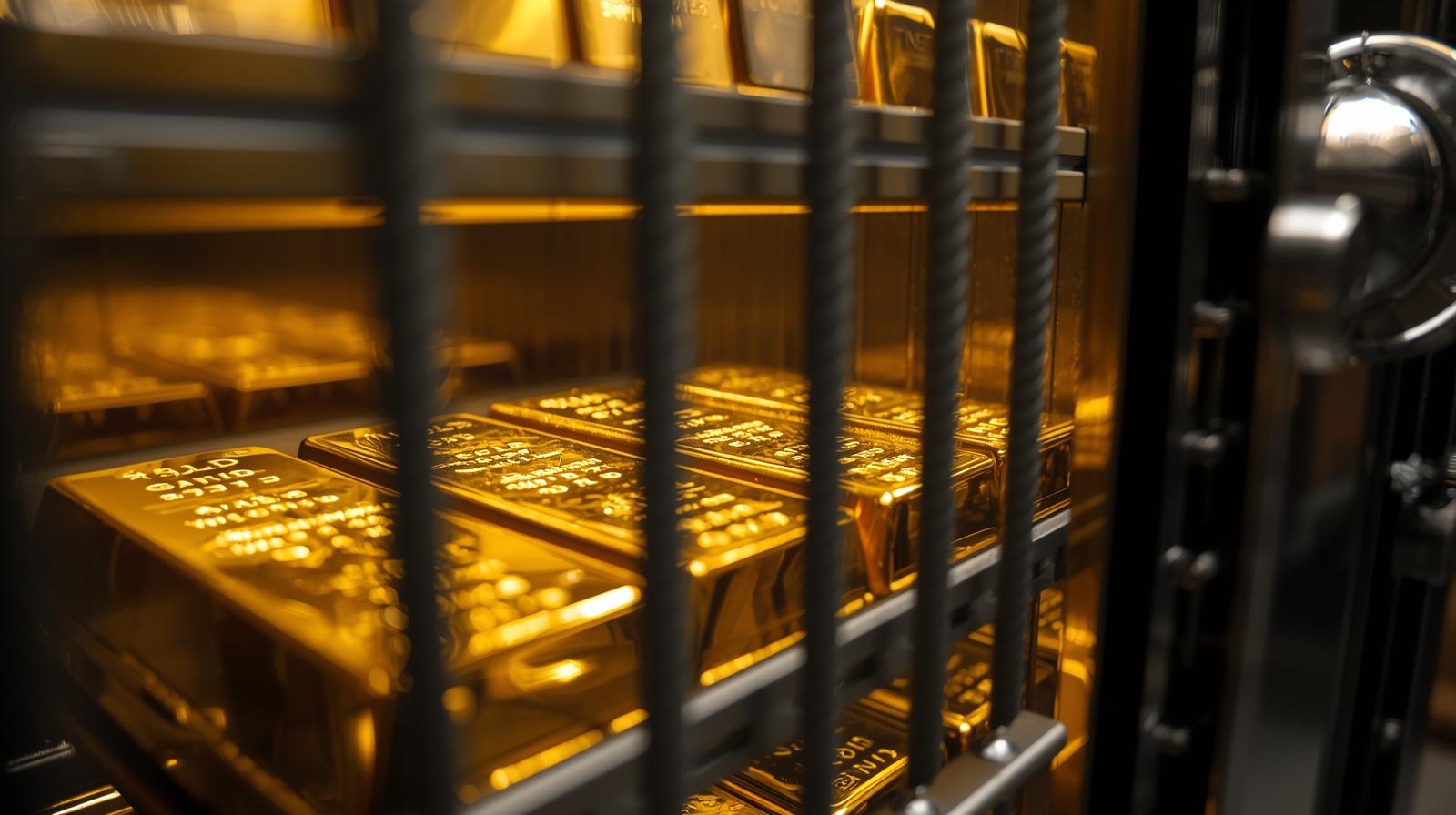

Gold’s role in modern portfolios has evolved alongside advances in trading technology. Today, U.S. investors can access gold in several forms, including physical bullion, futures contracts and digital gold offerings. Physical gold provides direct ownership, while paper and digital alternatives offer convenience and liquidity. These various investment options make it easier for traders to choose a method that fits their goals, whether they seek long-term preservation or short-term trading opportunities.

In addition to its financial value, gold carries psychological stability. Its deep historical connection to wealth gives many investors confidence during turbulent times. While emerging assets such as cryptocurrencies offer growth potential, gold provides reassurance grounded in centuries of proven performance. Many Americans view gold not as a speculative asset but as a foundation of financial security.

Understanding gold as an asset involves recognizing its unique position in the U.S. and global economy. Its scarcity, stability, independence from traditional markets and ability to perform during uncertainty make it an essential part of a well-rounded investment strategy. As markets continue to evolve, gold remains a dependable choice for those seeking long-term resilience, wealth protection and steady value in a changing financial world.